Tether, the organization behind the widely-used USDT stablecoin, has stirred controversy within the cryptocurrency community by extending loans of $5.5 billion in stablecoins, contrary to its previous commitment to cease such loans by the end of 2023, as reported by The Wall Street Journal.

This revelation has sparked concerns about Tether’s preparedness to manage a potential surge in redemptions and underscores its growing dominance in the stablecoin market, particularly as its primary rival, USDC, has been experiencing a decline in market share.

In December of the preceding year, Tether had publicly stated its intention to discontinue the issuance of loans using its token by the conclusion of 2023.

However, recent data indicates that not only did Tether persist in issuing loans, but it also raised the total value of loans extended to customers to $5.5 billion as of June 30, marking an increase from $5.3 billion in the preceding quarter.

Tether has released limited information regarding the borrowers and the collateral utilized for these loans.

According to The Wall Street Journal report, this development has triggered apprehensions regarding the financial soundness of Tether, as the substantial growth in loans associated with the stablecoin could potentially introduce risks should users begin to question its fiscal stability.

The increasing dominance of Tether:

Simultaneously, this situation aligns with the continuous rise of Tether’s influence in the stablecoin market, while its primary rival, USDC, has witnessed a decline in its market share.

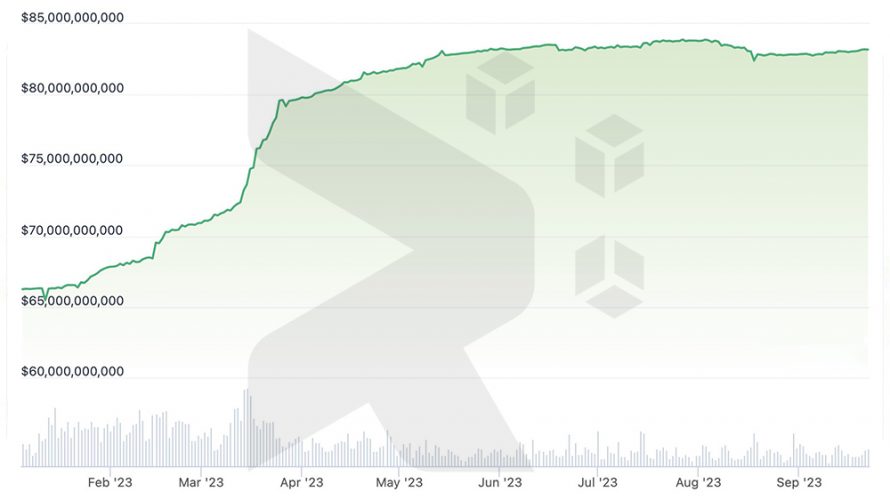

Conversely, Tether’s market share has been expanding, augmenting its capitalization by $10 billion in response to the challenges faced by USDC.

Tether market capitalization year-to-date

The expansion in market share has occurred despite the scrutiny that Tether has faced regarding the transparency of its operations and the inquiries raised about the liquidity and magnitude of the company’s reserves.

Determined to eliminate secured loans:

Tether has consistently asserted that every one of its in-circulation tokens is entirely supported by cash or other readily convertible assets.

In a statement released on Thursday, the company also mentioned that it has amassed over $3.3 billion in surplus reserves to offset its loan-related risks and emphasized its unwavering dedication to removing secured loans from its reserves.