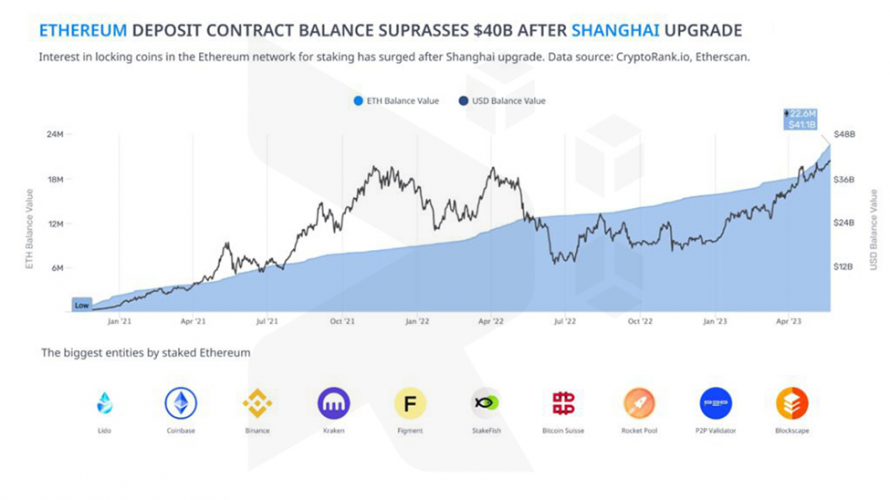

Following the highly anticipated Shanghai upgrade of Ethereum, over 4.4 million in $ETH have been placed into the ETH 2.0 staking contract since April 12th, showcasing significant interest in the new development.

After the recent and highly anticipated Shanghai upgrade, which has enabled validators to withdraw staked tokens, the Ethereum (ETH) network has experienced a significant surge in activity due to the rapidly increasing interest in staking.

Since April 12th, users have deposited over 4.4 million ETH, as reported by the cryptocurrency analytics firm CryptoRank Platform.

As per information from Cryptorank, a recent tweet has affirmed: “Following the Shanghai upgrade, there has been an exponential rise in the interest surrounding staking coins within the Ethereum network. Over 4.4 million ETH coins have found their way into the ETH 2.0 staking contract since April 12th.”

On May 24th, the Ethereum deposit contract balance reached a staggering 22.8 million ETH, equivalent to $41.4 billion, marking a substantial increase since the introduction of this latest upgrade.

Ethereum Experiences a Downturn

Ethereum, the second-largest cryptocurrency globally, is facing a challenging day as of now. It is presently valued at $1,814.75, reflecting a 2.2% decline over the last 24 hours. Its market capitalization has also decreased by 2.17%, now standing at $218,247,640,021.

Quoting CMC

Respected cryptocurrency analyst Michaël van de Poppe has weighed in on the recent movements of Ethereum (ETH).

In his tweet, he stated: “Regarding the price structure of #Ethereum, we haven’t seen significant changes. It appears that we may require several more days of consolidation before witnessing a breakout. It is crucial to maintain support above $1,825 to sustain this trend. If this holds, and we breach $1,880, I anticipate a relatively rapid ascent to $2,000.”

Meanwhile, Ethereum’s founder, Vitalik Buterin, recently issued a warning regarding the “overloading of Ethereum’s social consensus.”

He further elaborated: “We should exercise caution when application-layer projects take actions that could potentially expand the ‘scope’ of blockchain consensus beyond the verification of the core Ethereum protocol rules. While it is common for application-layer projects to explore such strategies, often without a full understanding of the associated risks, the outcome can easily diverge from the overarching goals of the Ethereum community as a whole.”

“But instead,” he continued, “we should maintain the chain’s minimalistic approach, support staking practices that do not lead to a slippery slope of broadening Ethereum’s consensus role, and assist developers in finding alternative strategies to achieve their security objectives.”