Glassnode stated that inscriptions have primarily served as “filler material,” inserted into any available space once more substantial monetary transfers have been included in the blocks.

Although there have been concerns about Bitcoin Ordinals potentially congesting the network, there is limited evidence to support the notion that inscriptions are crowding out blockspace needed for more substantial Bitcoin (BTC) monetary transfers.

“On-chain analytics firm Glassnode addressed this in its report on September 25 titled ‘The Week On-chain,’ stating, ‘There is minimal evidence that inscriptions are displacing monetary transfers.'”

This is likely because users of inscriptions typically opt for lower fee rates, indicating their willingness to wait for longer confirmation times.

“Inscriptions seem to be utilizing and acquiring the most economical blockspace that is readily displaced by more time-sensitive monetary transfers.”

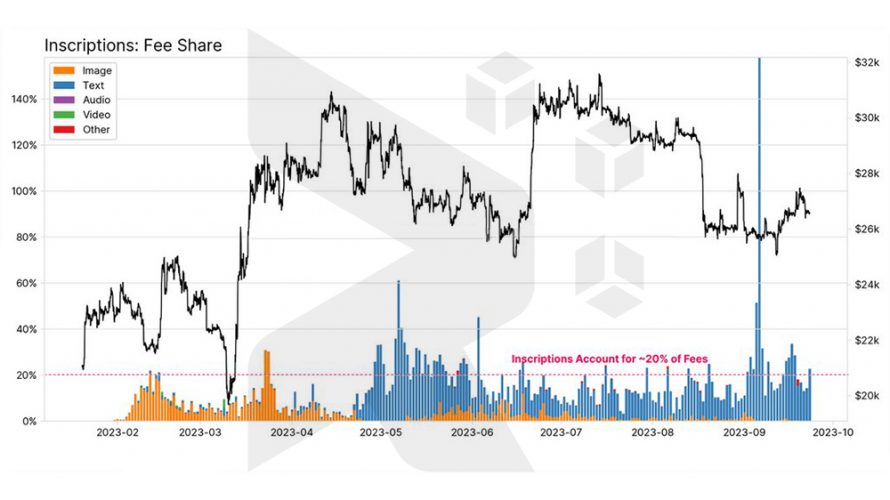

Bitcoin Ordinals made their debut in February 2023 and have since dominated network activity

Interestingly, this dominance has not translated into a proportional share of mining fees, as inscriptions only contribute to approximately 20% of Bitcoin transaction fees, as reported by Glassnode.

The increase in inscriptions has indeed boosted revenue, but there’s a caveat to consider. Although inscriptions have enhanced the fundamental demand for blockspace and raised fees for miners, Glassnode highlights that Bitcoin’s hash rate has concurrently surged by 50% since February.

This surge has led to intensified competition among miners vying for revenue from fees, as noted by Glassnode:

“Given the intense competition among miners and the impending halving event, it appears that miners may be approaching a precarious financial situation, with their profitability potentially at risk unless BTC prices experience a near-term surge.”

At present, Bitcoin is valued at $26,216, and there is a widespread belief among industry experts that some level of price appreciation will occur in the run-up to Bitcoin’s scheduled halving event in April 2024.

It’s worth noting that the majority of inscriptions currently originate from BRC-20 tokens, which were introduced about a month after Casey Rodarmor launched the Ordinals protocol on the Bitcoin network in February.

On September 25th, Rodarmor put forth “Runes” as a potential substitute for BRC-20 tokens, proposing that a fungible token protocol based on unspent transaction outputs could help mitigate the accumulation of “superfluous” unspent transaction outputs on the Bitcoin network.