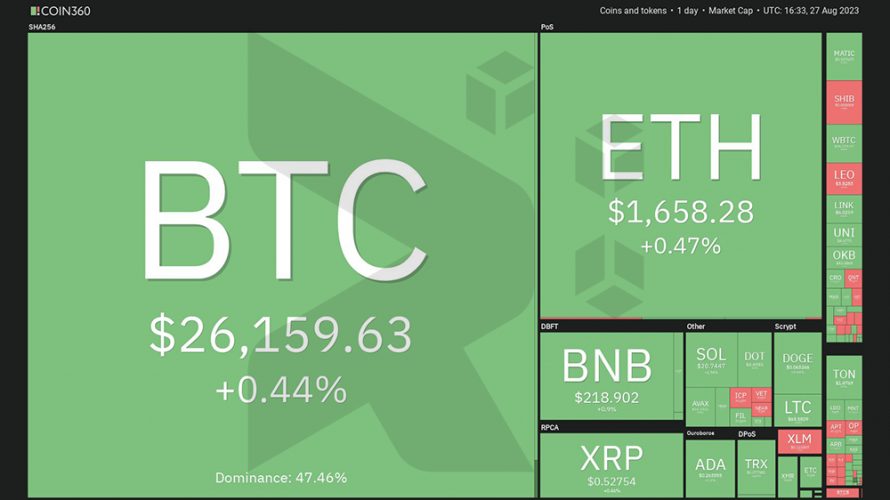

Bitcoin hovering around the $26,000 mark presents potential bullish trading opportunities for TON, XMR, MNT, and QNT.

The price of Bitcoin (BTC), currently standing at $27,415, exhibited a subdued demeanor over the weekend. According to Ki Young Ju, the CEO of CryptoQuant, in a recent X post (formerly Twitter), Bitcoin’s velocity has plummeted to a three-year nadir. This occurrence could be perceived as positive, indicating that prominent holders are retaining their positions. Conversely, it could also be viewed negatively due to the lack of transfer to new investors.

The consistent range-bound movement of Bitcoin continues to baffle investors as they speculate about the next discernible directional shift. On this note, JPMorgan analysts have expressed optimistic sentiment, suggesting that Bitcoin’s downtrend might be reaching its conclusion. Their stance stems from the observation of declining open interest in Bitcoin futures contracts on the Chicago Mercantile Exchange, hinting at the potential conclusion of long liquidation.

While Bitcoin contemplates its forthcoming trajectory, a handful of chosen alternative cryptocurrencies are demonstrating notable resilience. The trajectory of these altcoins might shift negatively should Bitcoin’s current range break towards the downside. However, in the event of a positive upturn or sustained consolidation for Bitcoin, these altcoins could potentially present a window for short-term trading prospects.

Delving into the technical analysis, we shall examine the chart patterns of the leading five cryptocurrencies that exhibit the potential for upward movement in the immediate future. In doing so, we will pinpoint the critical levels that must be surpassed for bullish momentum to assume control.

Bitcoin Price Assessment

Bitcoin underwent a noteworthy price action on August 26, manifesting an inside-day candlestick pattern. This signifies a state of uncertainty prevailing between bullish and bearish forces, each contemplating the next definitive movement.

The descending trend of the 20-day exponential moving average (set at $27,222) and the relative strength index (RSI) residing within the oversold zone strongly suggest the prevailing authority of the bears. Yet, the bullish faction is unlikely to capitulate without a robust endeavor. Their determination appears set on staunchly safeguarding the $24,800 level.

For the BTC/USDT pair to ignite a more substantial recovery, an assertive push by buyers to breach the 20-day EMA becomes pivotal. Such a development could potentially pave the way for an imminent surge towards the 50-day simple moving average ($28,888).

In counterpoint, if the bears seek to bolster their position, the strategic maneuver would entail compelling the price beneath $24,800. The execution of such a maneuver could potentially initiate a downward trajectory towards the $20,000 level.

The 20-day EMA on the four-hour chart is manifesting a stabilization, coupled with the RSI hovering near the midpoint. This configuration signifies a balanced interplay between supply and demand. Should the price undergo deterioration below $25,700, the pair’s trajectory could veer towards $25,166 and subsequently $24,800.

Conversely, if the pair successfully maintains its position above the moving averages, it would function as an indicator that the bulls have effectively absorbed the selling pressure. While a minor hurdle lies at $26,314, transcending this obstacle might propel the pair towards $26,610, followed by a possible advancement to $26,833.

Toncoin Price Evaluation

Toncoin (TON) is currently exhibiting the formation of an inverse head and shoulders pattern, poised to finalize upon achieving a breakout and subsequent closure beyond the $1.53 threshold.

The gradual ascent of the 20-day exponential moving average (notably at $1.38) coupled with the RSI residing within the positive territory collectively suggest that the pathway of least resistance leans towards the upward direction. Should buyers succeed in propelling the price above $1.53, it’s plausible that the TON/USDT pair could embark on a fresh upward trajectory, potentially aiming for the target indicated by the pattern at $1.91.

However, the bearish contingent is unlikely to be idle. Their strategy appears aligned with the goal of staunchly defending the $1.53 level and attempting to tug the price below the moving averages. Should they effectively execute this maneuver, it might precipitate a decline towards $1.25, followed by a potential further descent to $1.15.

Turning our attention to the four-hour chart, it becomes evident that the $1.53 level could potentially pose as a formidable barrier for buyers to surmount. If the price experiences a downturn from this level yet subsequently rebounds off the 20-day EMA, it could serve as an indicator that the bulls are strategically entering the market during minor declines. Such a pattern might enhance the likelihood of a successful breakout above $1.53, potentially setting the stage for a subsequent rally towards $1.70.

Conversely, a scenario where the price turns downwards and breaches the 20-day EMA would suggest that traders are securing gains in proximity to the $1.53 mark. This development might prompt the pair to descend towards the 50-day simple moving average (SMA), and potentially further towards $1.33.

Monero Price Assessment

Monero’s value, currently resting at $148, has exhibited a pronounced recovery by bouncing off the uptrend line for the second time within the past few days. This resilient response underscores the vigorous defense put forth by the bullish camp at this level.

For the XMR/USDT pair, a potential advancement towards the 20-day EMA ($148) lies ahead, a juncture anticipated to present a formidable barrier. Should the bulls manage to retain their stance near this level, the likelihood of an ascent beyond the 20-day EMA gains traction. A subsequent progression towards the 50-day SMA ($157) might ensue, although this could provoke selling pressures from the bearish faction.

However, should the price experience a swift downward reversal from the 20-day EMA, it would indicate the sustained selling inclination of bears during price rebounds. In this scenario, a retest of the uptrend line becomes conceivable. Prolonged retesting of a support level often leads to its gradual weakening. If this support eventually capitulates, the pair’s trajectory may experience a decline towards $125, followed by a potential descent to $115.

Analyzing the four-hour chart, the bulls have managed to push the price above the moving averages, indicating the potential erosion of bearish influence. Notably, a robust resistance rests at $150, yet surmounting this level could pave the way for a progression towards $160. The ascending 20-day EMA and the positive territory reading of the RSI slightly favor the buyers.

The first discernible sign of vulnerability would manifest as a breach and subsequent close beneath the moving averages. This development could exert a downward pull on the price towards the uptrend line. A subsequent break below this support could potentially trigger a decline, sending the pair plummeting towards $125.

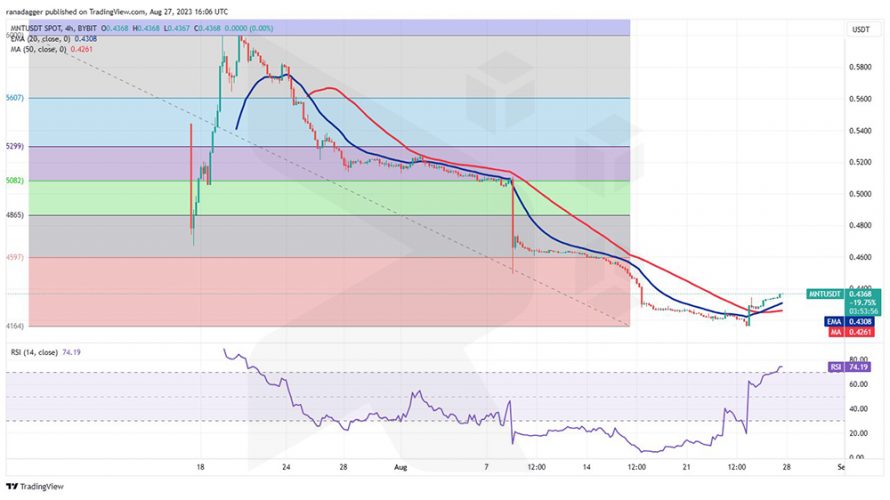

Mantle Price Assessment

Mantle (MNT) has exhibited a substantial downtrend since reaching its peak at $0.60 on July 20th. This pronounced downward trajectory has propelled the RSI into oversold territory, indicating a potential for a relief rally.

The emergence of an outside-day candlestick pattern on August 25th suggests that buyers are striving to seize command. In this context, the MNT/USDT pair could experience an initial ascension towards the 20-day EMA ($0.45), a pivotal juncture to observe closely. If buyers succeed in surmounting this hurdle, the pair might ascend towards the 38.2% Fibonacci retracement level positioned at $0.48.

On the contrary, a scenario where the price undergoes a downturn from the 20-day EMA would signal that bears persist in their pattern of selling during minor upward moves. This could potentially trigger a retest of the support at $0.41. Should this particular level falter, it might precipitate a further descent towards $0.35.

Analyzing the four-hour chart, it’s evident that the bulls have managed to drive the price above the moving averages. However, their efforts to initiate a substantial rally seem to encounter resistance. This indicates that bears are not yet relinquishing their grip, and they might present a challenge at elevated levels.

In the event of a breach beneath the moving averages, the advantage would shift towards the bears. Such a development would heighten the likelihood of a subsequent breach below $0.41.

Conversely, should the price maintain its position above the 20-day EMA, it would signify that bulls are strategically entering the market during minor downward fluctuations. In this scenario, the pair might endeavor to embark on a rally towards $0.47 and subsequently to $0.52.

Quant Price Evaluation

Quant (QNT), presently priced at $101.00, exhibited a resurgence from the robust support level at $95 on August 17th, subsequently surging above the moving averages on August 26th. This dynamic indicates a robust demand at elevated levels.

Bulls are poised to sustain this momentum, aiming to propel the price toward the downtrend line. This juncture is anticipated to host a fierce confrontation between bullish and bearish forces. Should the price experience a downturn from this point, yet recover upon rebounding off the 20-day EMA ($101), it would signify a shift in sentiment from selling during upward movements to strategically buying during downward oscillations.

Such a transformation might heighten the potential for a rally surpassing the downtrend line. In the event of such an occurrence, the QNT/USDT pair could potentially initiate a rally towards $120. This optimistic outlook could be challenged in the short term if the price turns downward and descends beneath the moving averages, potentially leading to a slide towards the $95 support level.

Assessing the four-hour chart, the moving averages have experienced an upturn, coupled with the RSI residing within positive territory. These indicators collectively imply a resurgent presence of the bulls. This might propel the pair towards the downtrend line, where the bears are likely to mount a resilient resistance.

On the downside, the moving averages are anticipated to serve as robust support levels. A breach and subsequent closure below the 50-day SMA would signify a potential conclusion of the recovery phase. In such an instance, the pair could potentially decline towards $98.

This news is only analytical and informative and is not a recommendation for investment in any way.