The cryptocurrency leader, Bitcoin, recently experienced a surge, reaching an impressive $35,280 approximately five hours ago. Clues to this rally were apparent as early as yesterday. Investors, who have been disheartened by false rallies over the past several months, initially approached this upswing with caution. However, as they cautiously embraced the momentum, the BTC price notched even higher levels. Presently, it strives to establish a strong foothold above the $33,000 mark, indicating resilience.

**Bitcoin (BTC) Hits $35,000**

With the commencement of the Asian markets, BTC crossed the $35,000 threshold, marking a promising turnaround from the bearish trends. Those who vividly recall the exciting days of the bull market likely remembered the heightened volatility during the initial hours of Asian market activity. With a positive daily closing, the persistent demand transformed into a substantial and electrifying upsurge.

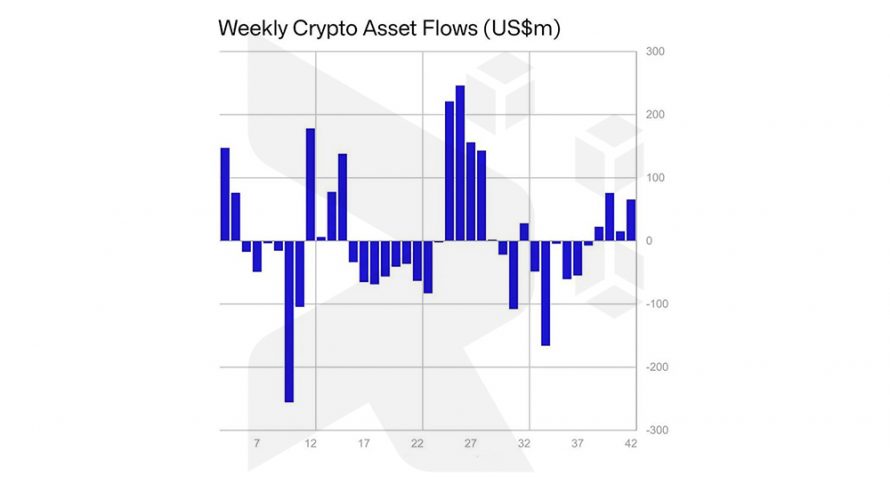

Bitcoin (BTC) has surged to its highest point since May 2022, a move that had been foreshadowed in the preceding weeks. The demand from institutional investors, which had been in a slump for the past two months, suddenly began to rise. Furthermore, the volume of crypto ETP (Exchange-Traded Product) offerings was showing signs of recovery. This surge in demand primarily emanated from professional investors, who had well-founded reasons to anticipate an upward trajectory.

The Ascendance of the Spot Bitcoin ETF

The primary catalyst behind Bitcoin’s remarkable ascent lies in the imminent approval of ETFs, despite the ongoing turbulence on the global stage and the ominous specter of potential conflicts. BTC enthusiasts remain steadfast in their optimism regarding this development, with several analysts receiving strong indications that asset management giant BlackRock is on the verge of unveiling its own ETF. The revelation from experts, just yesterday, suggesting that approval is right around the corner, sent ripples through the markets.

Notably, Bloomberg ETF analyst Eric Balchunas reported last night that BlackRock has secured a new license and is poised to commence the seeding process at the outset of this month.

“Seeding an ETF” refers to the utilization of a few creation units (comprising underlying assets, in this case, Bitcoin) to procure the initial creation units, which can subsequently be traded on the open market on the first day. Typically, this involves a bank or broker-dealer exchanging these units for ETF shares.

It’s essential to understand that the seeding period does not entail significant investments. Therefore, interpreting this as BlackRock preparing to acquire billions of dollars’ worth of BTC would be misleading.

**Cryptocurrency Highlights (Bullet Points)**

– Exercise caution as personal consumption expenditure data is set to be released this week.

– A finalized court decision regarding GBTC has led to a reevaluation by the SEC. The SEC is striving to find a new reason to deny the application, but the possibility of approval appears to be higher, potentially further boosting market demand.

– The final decisions on BlackRock and other ETF applications are expected in March. However, if the SEC chooses, they can expedite the process by granting approval as early as October.

– A letter from US Representatives urging the prompt approval of the ETF and the avoidance of future mistakes forms a basis for today’s optimism.

– BlackRock CEO Fink’s statement last Monday triggered the ongoing surge, with predictions of increased demand for cryptocurrencies in the near future and mentions of pent-up interest.

– Various Bitcoin metrics, such as volumes, traffic, and accumulation, have reached their highest levels since 2015 after a challenging bear market. This indicates a potential turning point for the cryptocurrency, with Bitcoin closures above $35,000 carrying significant implications and the potential to catalyze a recovery in altcoins.

The above news is only market analysis from reliable sources and Rublex will not be responsible for your profit and loss, please check the market before any action.