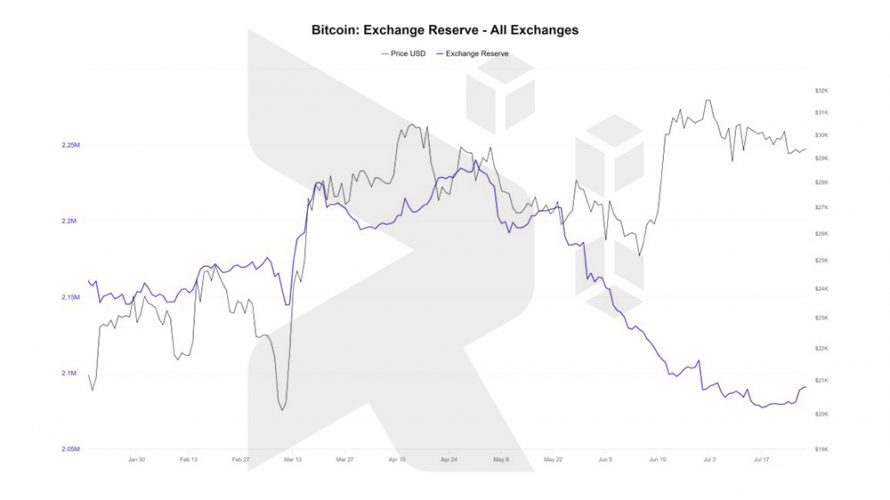

According to CryptoQuant data on September 20, the amount of Bitcoin (BTC) held by major cryptocurrency exchanges such as Coinbase, Binance, and Kraken has reached its lowest level in nearly six years.

This decrease in holdings coincided with a period of relative stability in the overall crypto market, following significant losses throughout most of August and the first half of September. As of September 20th, BTC prices remain below $30,000, albeit with significant sideways movement in recent weeks.

Bitcoin Exchange Reserves Declining

Based on current data, cryptocurrency exchanges are in possession of approximately 2.09 million BTC. It’s worth noting that the total supply of Bitcoin is capped at 21 million coins.

However, by 2023, more than 19.7 million bitcoins have entered circulation, with notable public companies like Tesla, the electric car manufacturer, and MicroStrategy, the business intelligence firm, actively accumulating them. Typically, entities can store cryptocurrencies in non-custodial wallets or on exchanges such as Binance or Coinbase.

Exchanges provide custodial wallets where users can securely store their coins for trading or long-term holding (HODLing). Users who choose to keep their coins on exchanges have the convenience of easily swapping them for USDT or other alternative cryptocurrencies. It’s worth noting that the number of coins held in exchanges is decreasing, which, while initially appearing positive, does not guarantee a price recovery on its own.

Traditionally, when coins are withdrawn from exchanges, it often indicates a strengthening market and anticipation of price growth. Nevertheless, given the prevailing regulatory landscape, traders and Bitcoin holders may be inclined to assert more control over their coins, driven by apprehension.

Consequently, an increasing number of holders are opting to safeguard their coins in non-custodial wallets as a precautionary step, which could help clarify the decline in Bitcoin exchange reserves.

SEC and Regulators Clamp Down on Exchanges

The quantity of Bitcoin held on exchanges has been steadily decreasing throughout 2022, with a more pronounced decline observed in late 2022. This period coincided with the collapse of FTX, a prominent cryptocurrency exchange, which resulted in the freezing of billions of dollars in clients’ assets.

While the outflow of Bitcoin slowed down in Q1 2023 following the collapse of certain regional banks in the United States, it has continued to decline since then. This decline can be attributed to the overall bearish market sentiment but is primarily driven by the United States Securities and Exchange Commission (SEC) taking stringent actions against Binance and Coinbase, citing allegations of regulatory non-compliance.

In June, the SEC filed lawsuits against both Binance and Coinbase, alleging that these two exchanges had been involved in the issuance of unregistered securities, with examples such as Cardano (ADA) cited. During this regulatory crackdown, particular attention has been placed on Binance US. Consequently, the platform has experienced significant staff departures, staff layoffs, and operational disruptions. The trading volume on Binance US has plummeted by more than 95% as a result of these developments.