Bitcoin’s surge beyond $33,000 raises questions about the “next wave” in cryptocurrency. A billionaire’s move to bolster gold and Bitcoin holdings amid US dollar concerns and an erroneous SEC approval report have added to the excitement. A potential US Bitcoin spot ETF approval could increase the market’s value by $1 trillion, making the upcoming Bitcoin halving event even more eagerly anticipated.

“US Court’s Ruling on Grayscale Sets the Stage for SEC’s Evaluation of a Bitcoin Spot ETF”

In a significant turn of events, the US Court of Appeals has instructed the Securities and Exchange Commission (SEC) to reconsider Grayscale Investments’ request for a Bitcoin spot exchange-traded fund (ETF).

This directive comes as a result of documentation filed on October 23 in the US Court of Appeals for the District of Columbia Circuit, following the SEC’s decision not to contest the court’s initial ruling on August 29.

Affirming the court’s August 29th ruling, the October 23rd order provides Grayscale with a fresh opportunity to convert its Grayscale Bitcoin Trust into a publicly-traded Bitcoin ETF.

The SEC has consistently refrained from greenlighting spot crypto ETFs on US exchanges but has approved investments linked to Bitcoin and Ether futures.

Moreover, on October 19th, Grayscale further solidified its position by submitting a registration statement to the SEC, with the aim of getting its Bitcoin trust shares listed on the New York Stock Exchange Arca under the GBTC ticker.

Other significant players, including BlackRock, ARK Investment, and Valkyrie, have similar applications for spot crypto ETFs awaiting SEC approval.

Impact on Bitcoin Price: This development has the potential to boost Bitcoin’s value. If Grayscale’s application secures approval, it could signify increased institutional acceptance, fostering greater liquidity and confidence in the cryptocurrency market.

Additionally, as prominent entities like BlackRock and ARK Investment await decisions on their applications, the anticipation and speculation surrounding these developments can lead to short-term price fluctuations.

Bitcоin Price Forecast

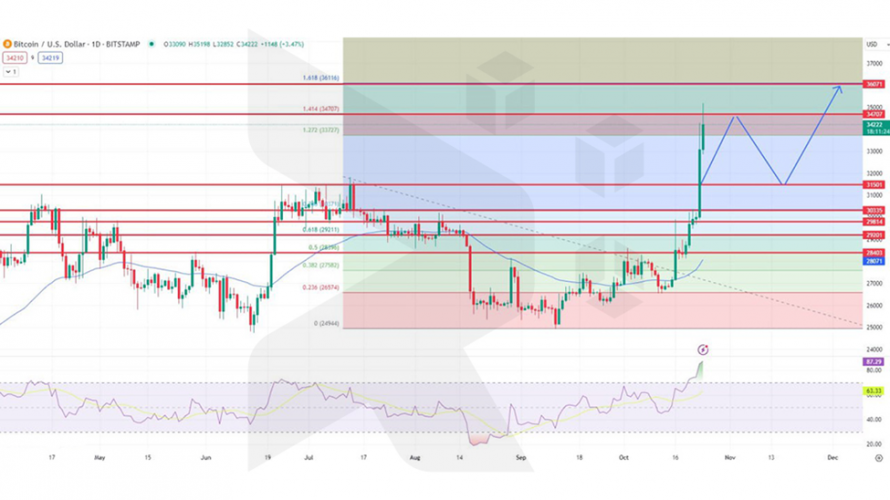

On October 24, Bitcoin (BTC/USD) was priced at $33,500, showing a 4.5% gain in 24 hours. Bitcоin remains the market leader with a market cap of around $625 billion and a circulating supply of approximately 18.6 million BTC. The 4-hour chart indicates resistance at $34,700 and support at $30,335, while the Relative Strength Index (RSI) at 87 suggests potential overbought conditions. An RSI above 50 typically indicates bullish sentiment.

Traders see crossovers as trend changes; Bitcoin remains bullish above $29,814.00 EMA. “Three White Soldiers” pattern indicates strong buying, but resistance at $34,700 and the RSI suggest possible bearish correction. Surpassing $34,700 may lead to a challenge at $36,071, while failure could test support levels. Research is essential for investment decisions.

The above text is only market analysis from reliable sources and Rublex will not be responsible for your profit and loss, please check the market before any action.