Block reported no impairment loss on its Bitcoin holdings, with Bitcoin revenue accounting for up to 43% of its total earnings.

Block, the Bitcoin-centric fintech company led by Jack Dorsey, released its Q3 earnings report on November 2, surpassing analysts’ expectations and revealing a profitable quarter.

During the third quarter of 2023, the company raked in $5.62 billion in revenue, driven by robust growth in both Cash App and Square, and netted $44 million in profits from its Bitcoin holdings, which benefited from a recent surge in Bitcoin prices.

In a shareholder letter, Dorsey outlined the company’s strategic focus and future plans, with particular emphasis on Square. He also highlighted key financial metrics from the third quarter, including the authorization of a $1 billion share repurchase to offset share-based compensation dilution.

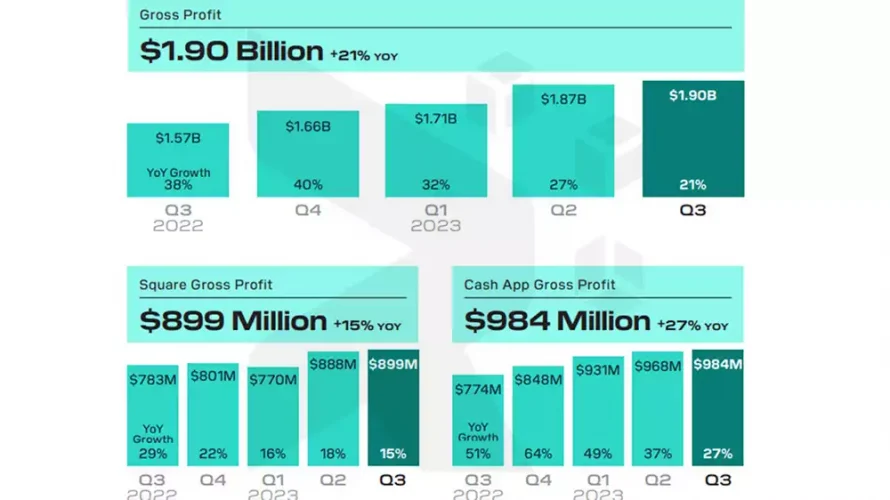

Block achieved a gross profit of $1.90 billion in Q3 2023, marking a 21% year-over-year increase. Cash App, the mobile payment service, delivered a gross profit of $984 million, up 27% year-over-year, while Square recorded a gross profit of $899 million, showing a 15% increase over the same period.

Approximately 43% of Block’s $5.6 billion in revenue was attributed to Bitcoin-related earnings. The fintech company’s third-quarter growth was further bolstered by robust consumer demand and increased spending.

Block’s Bitcoin gross profit reached $45 million, marking a 22% year-over-year increase, with the company selling $2.42 billion worth of BTC to customers through Cash App. The Bitcoin gross profit accounted for 2% of Bitcoin revenue. The company attributed the growth in BTC revenue to both the rising average market price of Bitcoin and the increased quantity of Bitcoin sold to customers.

Block also emphasized that it had not experienced any impairment loss on its Bitcoin holdings since the previous quarter. As of September 30, 2023, the carrying value of Block’s Bitcoin investment was $102 million. However, based on observable market prices, its fair value stood at $216 million, which was $114 million higher than its carrying value.