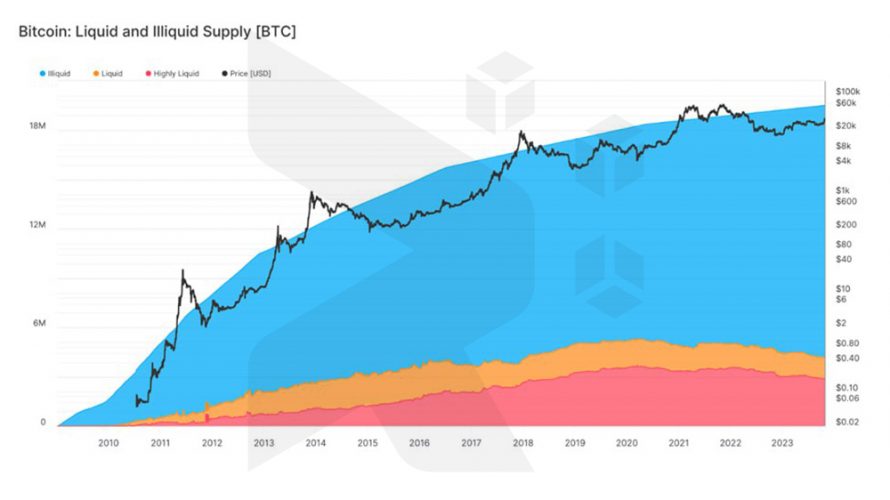

The Bitcoin market is presently experiencing significant shifts in its liquidity dynamics. As the illiquid supply reaches a record high of 15.3 million BTC, accounting for around 78% of the circulating Bitcoin supply, it indicates a growing cohort of investors committed to their long-term Bitcoin holdings.

Concurrently, the liquid supply has retreated to levels last seen in 2012, standing at 1.3 million BTC. This declining trend suggests a potential change in the market’s behavior, with more participants adopting longer-term holding strategies, effectively joining the ranks of ‘illiquid entities.’

Moreover, the highly liquid supply has undergone a significant reduction over the past three years, dropping from 3.7 million BTC in March 2020 to the current 2.9 million BTC. This decline could signify a decrease in active traders or entities engaged in rapid Bitcoin transactions.

Collectively, these liquidity dynamics indicate a tightening of Bitcoin’s active supply. The combination of a growing illiquid supply and diminishing liquid and highly liquid supplies can potentially create a ‘short squeeze’ scenario. This occurs when the limited active supply in the market struggles to meet trading demand, potentially triggering rapid upward price movements as traders rush to cover their short positions.

The above news is only market analysis from reliable sources and Rublex will not be responsible for your profit and loss, please check the market before any action.