While current usage may be declining, the outlook for the cryptocurrency sector remains promising due to its increasing acceptance in emerging economies, as highlighted by Chainalysis.

A Chainalysis report reveals that India leads global crypto adoption, followed by Nigeria and Vietnam. However, North America, primarily the United States, still plays a significant role in the cryptocurrency market. The study suggests that crypto adoption is down worldwide, except in lower-middle-income countries like India and Nigeria, where it remains strong. This trend is seen as promising for the future of cryptocurrency.

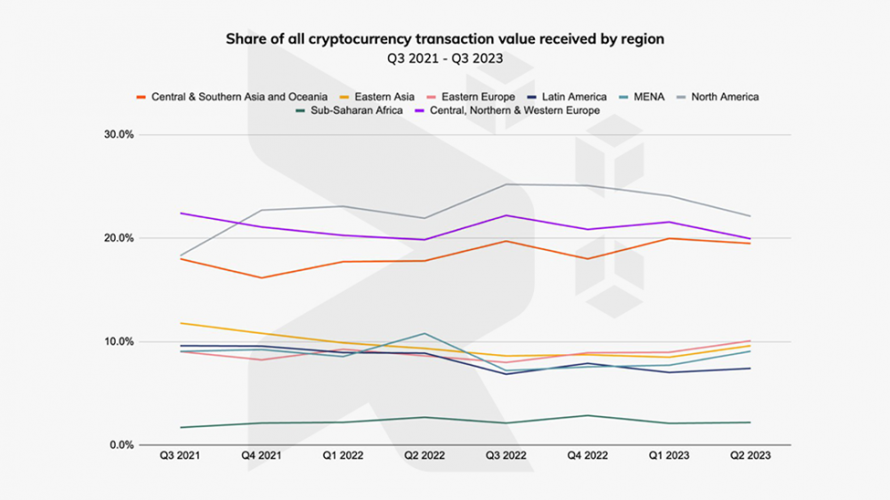

The leading regions for transaction value received are Central and Southern Asia, Oceania, Central, Northern, and Western Europe, and North America.

North America led in crypto market volume, but institutional transactions dropped from April, stablecoin share decreased from 70.3% in February to 48.8% in June, and DeFi transactions fell from over 75% in August 2022 to under 50% in July 2023.

Central, Northern, and Western Europe made up 17.6% of received crypto value, with the United Kingdom leading, more than twice Germany’s volume, and ranking 14th globally in adoption.

France led in DeFi growth, with Central and Southern Asia, Oceania, Eastern Europe, and Central, Northern, and Western Europe also experiencing year-on-year growth in DeFi in the 12 months ending in June 2023.

Central and Southern Asia and Oceania made up 19.3% of cryptocurrency value received by exchanges, led by India, surpassing Vietnam by around 100%.

Despite regulatory bans in China from 2020, the country contributed over $75 billion in exchange-received value in the year ending in June, with about three-quarters managed by centralized exchanges.

In the Middle East and North Africa, Turkey leads in NFT web traffic, Saudi Arabia shows a 12% transaction growth, and Nigeria dominates transaction volume, making up 2.3% of the global total. Bitcoin is highly popular in the region, comprising 9.3% of volume, compared to 4.2% in Eastern Asia.

In Latin America, with Mexico and Puerto Rico included, Argentina and Brazil are the top transaction contributors. The report emphasizes cryptocurrencies’ role in shielding users from inflation in this region.