In the third quarter, Tesla retained its substantial Bitcoin holdings while increasing its investment in artificial intelligence and research and development.

In the fifth consecutive quarter, electric vehicle manufacturer Tesla maintained its substantial Bitcoin holdings without making any changes. However, the company allocated more resources to double its computing capacity, furthering its artificial intelligence (AI) initiatives.

Tesla’s Q3 2023 financial results, unveiled on October 18, indicate that as of September 30, the company possessed $184 million worth of digital assets, representing a portion of the $1.5 billion worth of Bitcoin it initially acquired in March 2021.

These latest quarterly results demonstrate that Tesla did not engage in Bitcoin buying or selling activities following its 75% sell-off of holdings in the second quarter of 2022, which yielded $936 million from over 30,000 BTC.

Tesla doubled its computing capacity for AI projects, shifting the training of its humanoid robot Optimus to AI. Despite this, Tesla’s third-quarter earnings and profits were below Wall Street estimates, with total revenues reaching $23.35 billion, slightly under Zacks Investment Research’s projected $24.38 billion.

Tesla fell short of expected profits, reporting earnings per share (EPS) of $0.66, below Zack’s estimate of $0.72 EPS. The company’s total third-quarter operating expenses amounted to $2.41 billion, reflecting a 13% increase from the previous quarter and a 42.5% increase from the prior year. Tesla’s research and development expenses for the quarter were $1.16 billion, representing a 58% increase from the previous year. The company attributed these increases to investments in projects such as the “Cybertruck, AI, and other R&D initiatives.”

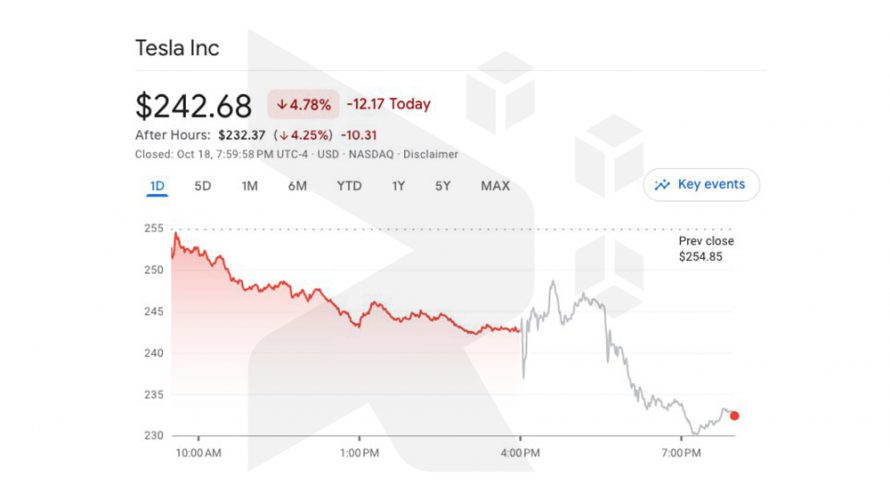

Tesla’s shares experienced a decline of nearly 4.8% during the day, closing at $242.68. In after-hours trading, they fell by an additional 4.25% to $232.37, according to Google Finance data.