ETF developments have contributed to the rise in Bitcoin and Ethereum coin prices, indicating a shift in the traditional finance sector’s attitude towards cryptocurrencies.

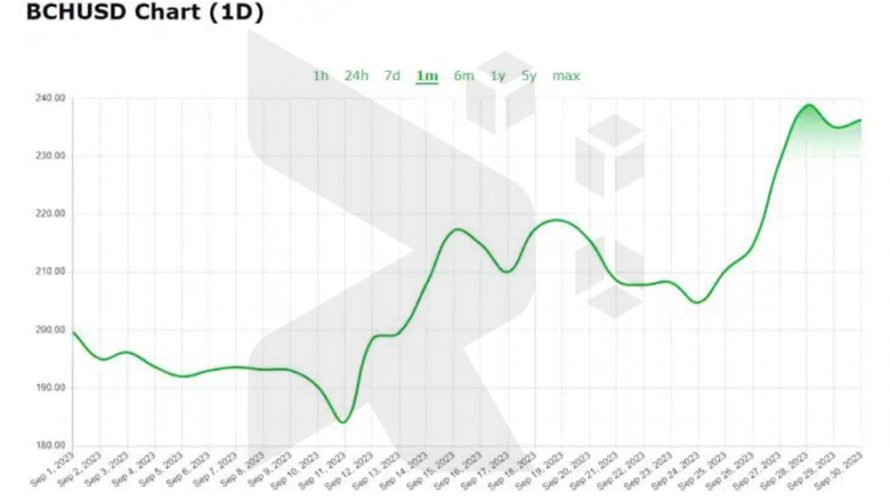

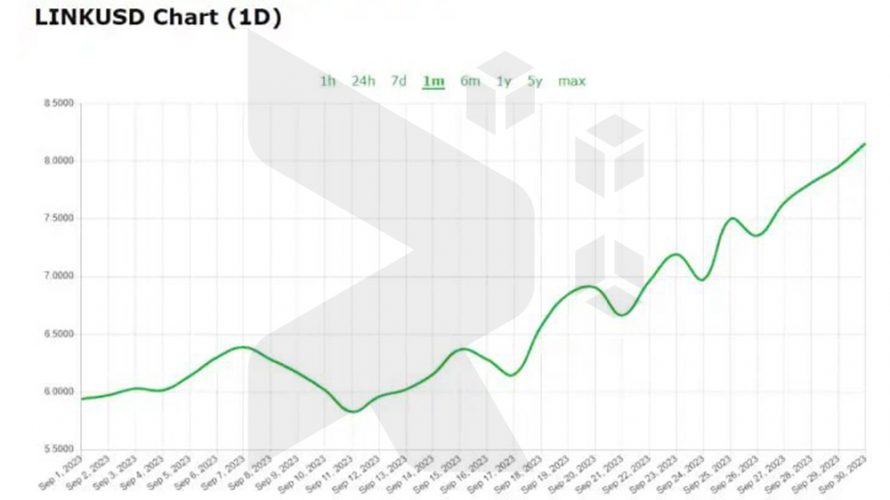

Chainlink and Bitcoin Cash have witnessed significant price fluctuations, particularly due to LINK’s integration on Coinbase’s layer-2 platform, which has garnered considerable attention.

Hong Kong’s Securities and Futures Commission (SFC) is taking the lead in implementing measures to enhance transparency in the crypto industry, prompted by the JPEX fraud case that resulted in victims losing HK$1.43 billion.

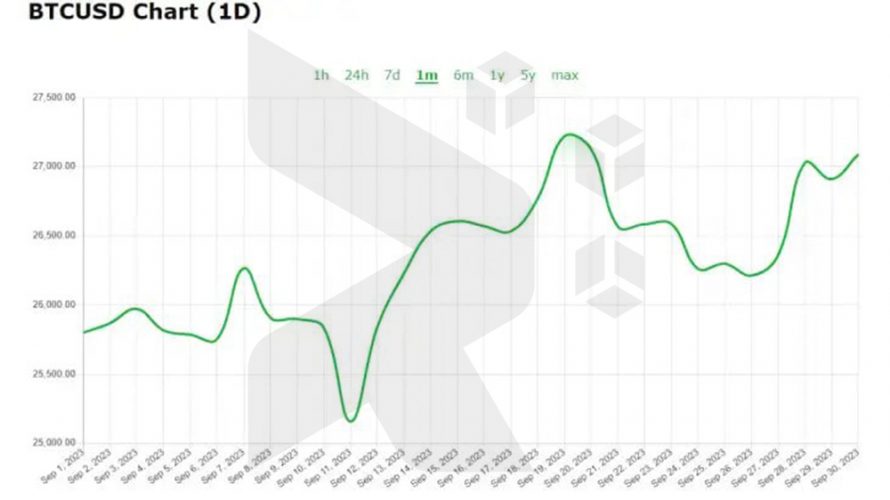

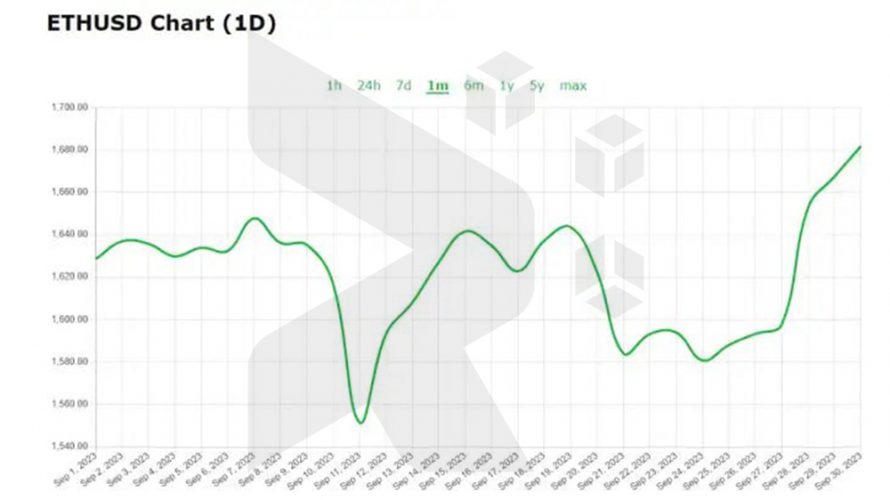

Bitcoin and Ethereum Respond to ETF Developments

The crypto market has experienced a relatively stable year. Upon reflection, we can observe a significant increase in the price of Bitcoin, starting at around $16.5K at the beginning of the year and currently standing at $26,972. This week, Ethereum also saw a price surge of 4.7%, reaching $1,672. This boost can be attributed to the confirmation of VanEck’s Ethereum Futures ETF, which has generated interest among investors. ETFs provide a means to engage with cryptocurrencies without the complexities of direct ownership. However, the SEC remains cautious in its approach to crypto spot ETFs, as evidenced by the recent postponement of decisions regarding various spot ETF applications.

Spotlight on Bitcoin Cash and Chainlink

Bitcoin Cash and Chainlink emerged as the standout performers among the top thirty cryptocurrencies by market capitalization this week. Bitcoin Cash experienced a notable surge of 11.8%, reaching a trading price of $234.13. Chainlink, on the other hand, attracted attention not only for its impressive 14% increase to $7.72 but also for its recent expansion of cross-chain capabilities onto Coinbase’s Ethereum layer-2 network. This integration has positioned Chainlink as a significant participant in facilitating interoperability across different blockchain networks, reaffirming its significance within the cryptocurrency industry.

Regulations and Developments: Hong Kong’s Position and The JPEX Case

Despite a generally quiet week in terms of political or institutional developments, Hong Kong’s Securities and Futures Commission (SFC) announced measures on Monday to enhance transparency and security in the crypto space. This decision was largely influenced by the JPEX case, in which a crypto exchange based in Dubai allegedly operated without proper licensing in Hong Kong. Considered as one of the largest financial fraud cases in Hong Kong’s history, this incident resulted in victims losing a staggering HK$1.43 billion.

Stablecoin Movements: Circle’s EURC on Stellar

A significant development in the realm of stablecoins occurred as Circle launched its fiat-backed stablecoin called EURC on the Stellar blockchain. This event positions Stellar as the third blockchain, alongside Ethereum and Avalanche, to support this particular stable coin. As stablecoins continue to gain popularity, such actions demonstrate the evolving dynamics of crypto platforms and their efforts to achieve greater interoperability and scalability.

Conclusion

The crypto movements witnessed this week emphasize the intricate relationship between regulatory developments and market dynamics. While Bitcoin and Ethereum coin remain influential in traditional finance through the introduction of ETFs, alternative cryptocurrencies like Chainlink and Bitcoin Cash are making progress both in terms of price and technological advancements. As the year unfolds, these activities underscore the relentless evolution of the crypto world, even during seemingly “slow” weeks.