Amkor Technology (AMKR Stock) made an announcement on Wednesday regarding a secondary public offering of 10 million shares by one of its stockholders, 915 Investments. It’s important to note that Amkor Technology itself will not receive any proceeds from the sale of these shares by the selling stockholder. This development had a significant impact on the stock price, with an initial gap-down opening of 15% and a total decline of 16% by the closing time.

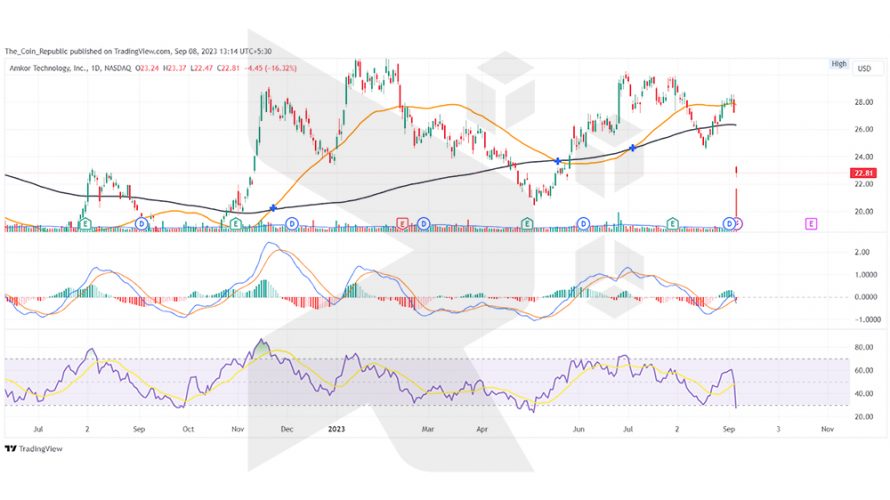

Over the past six months, Amkor Technology’s (AMKR Stock) price has exhibited substantial volatility, experiencing significant fluctuations within a 40% range. The stock has found support around the $20 mark and resistance around $30. Looking ahead, the long-term outlook for the stock price appears bullish, as it currently trades near a recent high and seems to be forming a trading range.

Examining the daily chart, we observe that the price faced resistance at the 50-day Exponential Moving Average (EMA), and the news of the secondary public offering led to a gap-down opening, causing the price to dip below the 200 EMA. However, a positive aspect for the stock is that it remains above the critical support level of $20.

Analysts providing a one-year price forecast for Amkor Technology have set a maximum estimate of $36, indicating a potential upside of more than 57%. Amkor Technology specializes in packaging and testing services for outsourced semiconductor products, encompassing design, packaging, characterization, and more.

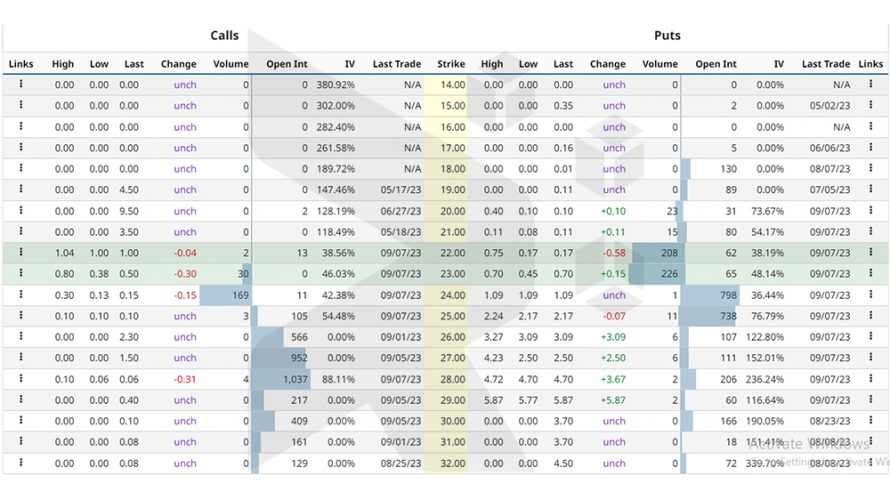

According to the analysis of the AMKR stock option chain, the current implied volatility in the market stands at 40.71%, showing a 6% increase in the last trading session. At the at-the-money strike, there is an open interest (OI) of 62 on the PUT side and 13 on the CALL side, signifying a prevalence of buyers at the current market price (CMP).

On Thursday, AMKR’s stock price experienced a 15% decline during pre-market trading.

As of Thursday’s intraday session, the AMKR stock price is currently trading at $22.81, marking a significant drop of almost 16%. The short-term price prediction suggests that the price could potentially see further decline, possibly reaching the key support level of $20, which represents the nearest buying zone.

The AMKR stock price has slipped below the critical moving averages.

The daily chart of AMKR stock price reveals a rejection from the 50-day EMA, indicating the presence of sellers at higher price levels.

The overall Technical Opinion rating, which considers RSI and MACD signals, suggests a 24% sell rating, reflecting a neutral short-term outlook on the current price direction.

In Summary

Amkor Technology (AMKR stock), a semiconductor packaging and testing service provider, witnessed a 16% drop in its stock price on Thursday following a secondary public offering of 10 million shares by a stockholder. The price experienced a gap-down below the 200 EMA and could potentially decline further to the $20 level, a significant support zone. Over the past six months, the stock has exhibited volatility, trading within the range of $20 to $30. Looking ahead, the long-term outlook appears bullish, with analysts projecting a maximum estimate of $36 for the next year.

Technical Levels

Support levels: $20.87 and $18.37.

Resistance levels: $27.54 and $29.06.

Disclaimer

The views and opinions expressed by the author, or any individuals mentioned in this article, are provided for informational purposes only and do not constitute financial, investment, or other advice. Investing or trading in cryptocurrencies or stocks carries inherent risks of financial loss.