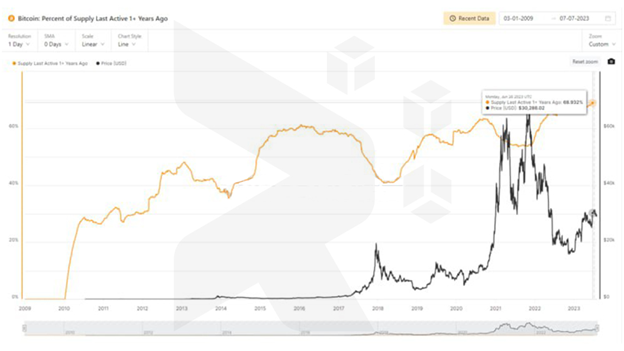

In an unprecedented development within the realm of cryptocurrencies, close to 70% of the entire Bitcoin supply has been retained for the extended term, as per statistics provided by Glassnode.

Illustration of Bitcoin (BTC). Picture: Unsplash

Marking an unprecedented occurrence in cryptocurrency history, nearly 70% of the total Bitcoin supply has been secured for the long haul, as reported by Glassnode’s data. As of August 8th, over 13 million BTC, equivalent to a value of approximately $380 billion, have remained inactive for a minimum of one year.

The data underscores that steadfast investors have upheld their Bitcoin holdings throughout the bear market, subsequently amplifying their market stake.

This signifies the inaugural instance, dating back to its establishment in 2009, where such a substantial quantity of BTC has been maintained for a span exceeding one year.

The count of persistent Bitcoin holders has been on the rise since its inception in 2009.

Investors with a long-term vision maintained comparable volumes up until 2016 and the period preceding the bullish market of 2021. Approximately 60% of the entire BTC supply lay dormant throughout these intervals.

However, a substantial divestment of these holdings took place as Bitcoin surged to its record peak by the conclusion of 2021. Dormant BTC dwindled to 53%.

A similar decline was observed during the bullish market of 2017. The quantity of inactive BTC plummeted from about 57% in May 2017 to 42% by March 2018.

Long-Term Bitcoin Holders’ Trends

When examining the behavior of Bitcoin holders over even more extended periods, there is a noticeable upward trajectory. A remarkable 56% of Bitcoin has remained inactive for durations surpassing two years, while 40% has remained untouched for a minimum of three years.

“Reflecting the prevailing accumulation strategy favored by long-term holders, this trend underscores a strong faith in Bitcoin’s enduring value, even amidst the well-known downturns characterizing the cryptocurrency market over the past twelve months,” commented a Bitfinex representative in conversation with CoinDesk.

Short-Term On-Chain Activities

Zooming in on the short term, the crypto analytics platform Santiment recently observed significant activities involving whale holdings and addresses. According to their findings, BTC has been gradually accumulating.

“After a month of whales slightly reducing their Bitcoin holdings, we’ve noticed some swapping of stablecoins for more BTC. Should this pattern persist, we might witness a rapid rebound in prices, potentially surging beyond $30,000,” stated a tweet from Santiment.

The analysis also unveiled a surge in interactions with BTC addresses.

The firm reported, “Bitcoin’s address engagement has surged to its highest point in 3.5 months, during August. This rise in utility, coupled with notable loss transactions and pessimistic sentiment, strongly indicates a plausible short-term (at the very least) rebound in BTC prices.”

Bitcoin’s Approaching Halving Event

The largest cryptocurrency is currently preparing for its highly anticipated event – halving. Occurring every four years, Bitcoin halvings lead to a 50% reduction in mining rewards for newly minted blocks.

BTC’s mining rewards are set to halve in either April or May 2024, with the precise date yet to be determined.

Historically, halvings have triggered price movements in the cryptocurrency. Following the last three halvings, BTC has surged to new all-time highs within the subsequent year or so.

BTC’s Current Valuation

As of August 8, 2023, Bitcoin is trading at $29,300. Over the past 24 hours, it has appreciated by 0.84%, and in the previous seven days, it has gained 1.40%.

With a market capitalization of $569 billion, Bitcoin remains the dominant cryptocurrency. Its 24-hour trading volume stands at $13 billion.

Presently, there are 19.45 million BTC in circulation, with approximately only a third of this total residing in active wallets.

Diverse Bitcoin Projections

Divergent forecasts abound concerning Bitcoin’s future. Some industry experts bet on robust growth in the near term. Adam Back, the CEO of Blockstream, recently projected that BTC will reach a new all-time high of $100,000 before the 2024 halving date.

Likewise, Samson Mow, CEO of Jan3, echoed a sentiment of a fresh BTC record price being achieved before the halving event.

Conversely, Bitcoin company NYDIG takes a more pessimistic stance, pointing to the recent Litecoin halving that failed to generate substantial price movement in LTC cryptocurrency.