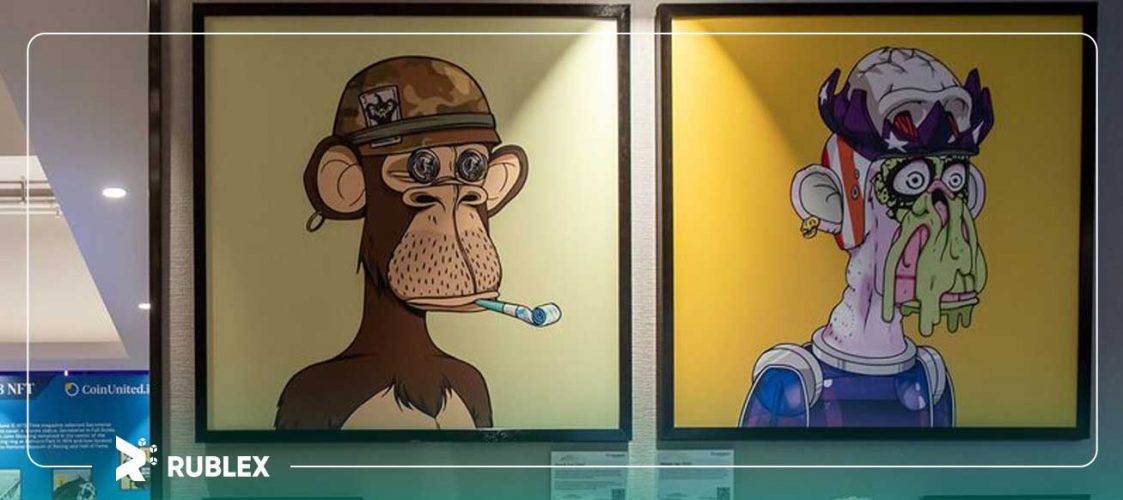

Justin Bieber’s investment in the NFT space has proven to be a costly endeavor. The renowned global singer joined the Bored Ape Yacht Club (BAYC) last year and has since suffered significant financial losses. In January 2022, Bieber acquired Ape #3001 for 500 ETH, valued at $1.3 million at the time. However, the current worth of the same collectible is a mere 29.95 WETH ($58,610) according to OpenSea, reflecting a staggering 95% decline in value.

In a similar vein, Bieber’s purchase of Ape #3850, made for 166 ETH ($470,000) less than a week later, is now being bid for 30.06 WETH ($58,898.56). These NFTs, commonly referred to as “non-fungible tokens,” gained immense popularity in 2021 as a speculative asset during the crypto market boom. They also provided an avenue for celebrities and creators to engage with their audiences through unique digital collectibles.

Critics of Bieber’s NFT investments pointed out that neither of the acquired NFTs possessed significant rarity, making his extravagant spending on what is known as a “floor ape” subject to widespread censure. The term “floor price” pertains to the lowest bidding price for an NFT within a specific collection.